Table of Content

For instance, American Collectors Insurance supplies coverage on extra than just automobiles. They’ll insure your vintage wine, stamps, books, artwork, or guitars if you’re fascinated. Based in Cherry Hill, New Jersey, American Collectors Insurance has been providing protection to classic vehicle collectors since 1976. American Collectors Insurance is well among the top two suppliers of classic automobile insurance, alongside Hagerty Insurance. There are causes you may select American Collectors Insurance over the opposite choices, which we’ll element in our evaluate under.

Most collectible car insurance policies require the vehicle to be saved in a garage so you'll need to doc where the vehicle is stored. Classic automotive insurance is often an “agreed-value” which means you and your insurer will agree on a worth of the car and your premium shall be primarily based on that value. You will need to have documentation that backs up your valuation. There are additionally quite a few specialty insurers that only deal with classic cars. Most of these automobiles spend extra time in a garage than out on the highway. They mainly hit the street for brief drives on the weekend, a automobile present or different particular event and generally, they are only out of the garage when the weather is good.

How To Economize On Classic Car Insurance

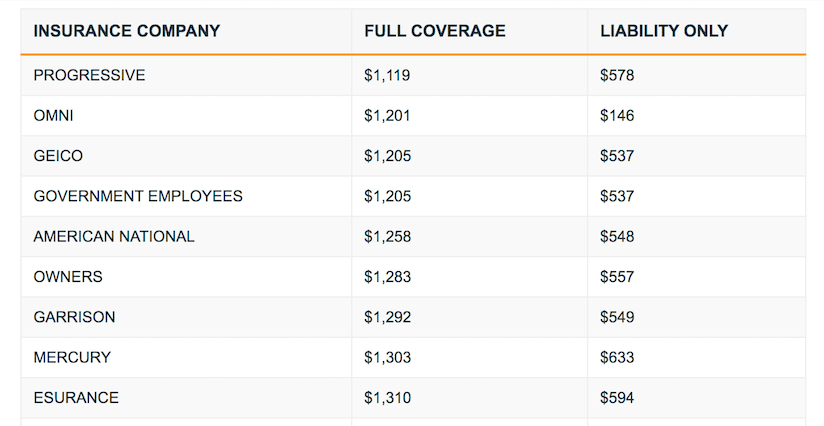

Most basic automotive insurance firms set a limit of 10,000 miles per yr or much less. The greatest companies offer greater mileage, limitless mileage or unrestricted use. Some companies with no mileage caps still set restrictions on how usually you'll find a way to drive your basic automotive. Look for versatile mileage options if you drive your basic car every day or each weekend, or when you drive it to car exhibits that aren't exactly native. Once you have gathered the entire above info you can simply shop for collector automotive insurance quotes. Get quotes from a minimal of 5 different insurers, examine with normal insurance firms such as Progressive as well as the specialty collectible automobile insurers such as Hagerty or J.C.

As a end result, the collector automobile is generally pushed for fewer miles yearly. This interprets to lower claims and harm prices, which leads to lower insurance coverage premiums for classic automobile insurance prospects. • Traditional or common auto insurance covers you for the Actual Cash Value of the car. Regular auto insurance is mostly applicable for newer autos that are depreciating in value, driven often, or where replacement autos are broadly obtainable. Because these automobiles depreciate, a claims adjuster determines the ACV estimate for the car AFTER a “total loss” accident occurs. The ACV is calculated by estimating the depreciated value the automobile and adjusting this estimate for extra mileage, vehicle situation, location, etc.

What Types Of Cars Do You Cover?

If your historic vehicle is held collectively by rust and duct tape, you may have hassle finding collector automobile protection. Although traditional automobile insurance corporations don’t always require value determinations, they've qualifications you and your car must meet. • American Collectors offers TreasureGuard Classic and Collector Car Insurance. An industry-leading traditional auto insurance coverage policy supplied by American Collectors Insurance . To discover the most effective traditional car insurance, we seemed on the prime insurers available nationally to discover out a car insurance company that offers protection well-suited to a big selection of classic automotive types. We looked for insurers with good discounts and few restrictions on when and the way you can use your automotive.

Classic car insurance policies pay an agreed-upon value instead of the particular cash value of the car at the time it is totaled. When shopping for the best basic automobile insurance coverage, consider your unique car insurance coverage needs. Do you need protection for roadside help in addition to the tools used in the repairs? Consider your wants after which get quotes from a few of the highest suppliers for the most effective charges.

The companies above are simply a number of the carriers obtainable for classic automotive insurance. It’s important to pay attention to the details as you store to ensure you get one of the best insurance coverage for you. Some other specialty auto policies, and a typical daily-use auto policy, supply stated value protection. In fact, it is really just precise money value coverage with a most limit – the said value – and the service pays the vehicle’s market value which it determines after the loss. If the market worth has dropped since the coverage was bought, then that lower dollar amount is the payout. The excellent news is that all kinds of collectible cars can qualify for traditional automobile insurance coverage.

For this reason, insurance providers usually use an agreed-upon value, which is the present market value of the automobile along with your investment into it. To qualify for traditional automobile insurance coverage, a vehicle should be driven primarily for pleasure or pastime use and is NOT pushed often for business, commuting, or different basic use. Offers $2,000 in standard spare parts protection, which is four occasions extra protection than the usual $500 supplied by most firms. You'll also get inflation guard, a perk that ensures your coverage quantity goes up as your automotive will increase in value. Both bodily damage and property harm liability coverages are part of a classic car policy. This protects you if you injure a person or their property along with your classic car.

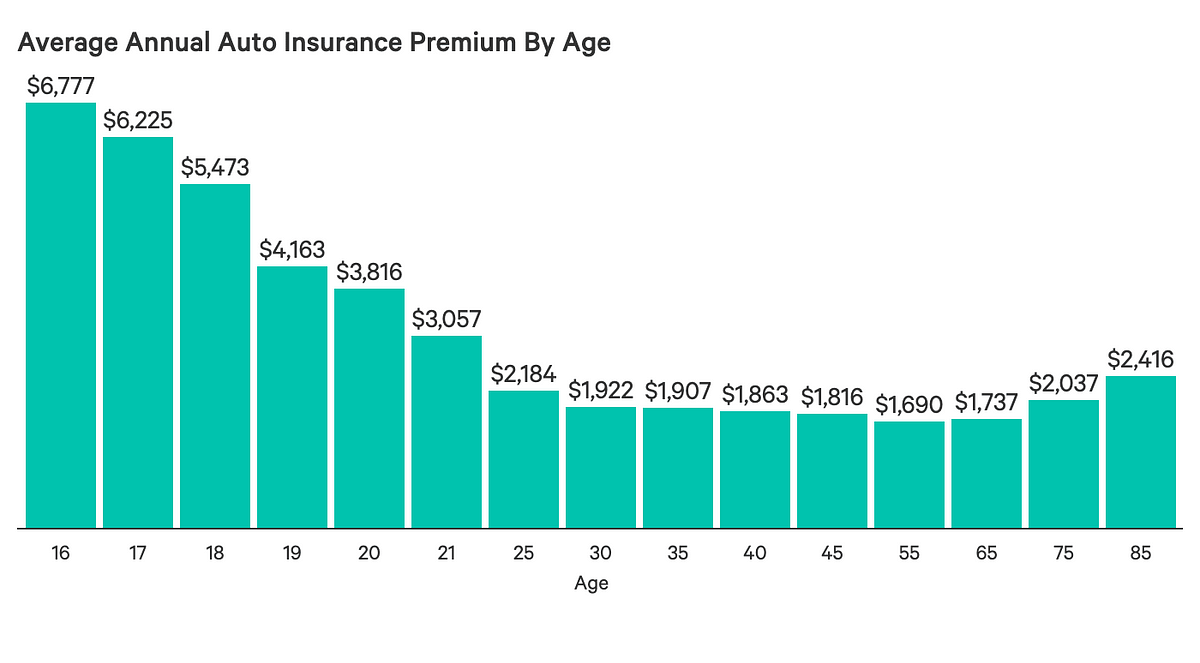

In addition, they have a tendency to appreciate rather than lose value over time. Find out the particular requirements of the insurance coverage supplier to ensure you do not void the policy. Some policies even have a minimal age requirement, requiring the driving force to be no less than 25 years old.

Stay informed about group occasions and collector car clubs in your area. If your automobile was totaled, you'd receive the agreed worth of the automobile. Some insurers additionally offer online instruments to assist you accurately worth your vehicle, including American Collectors and Hagerty. This perk protects you from theft or harm of replacement elements and is good for rare car fashions with hard-to-find parts. Most companies offer $500 or much less, whereas a couple of offer as much as Hagerty's $750 or American Modern's beneficiant $2,000 benefit.

Best Insurance Rates For Classic Vehicles

For instance, we priced out insurance coverage for a 1966 Jeep CJ5 and it got here in at $151 per year, but that’s with the least expensive $300 deductible. You can regulate that deducible primarily based on a dollar figure, or you can make it a share of the car’s value. Among the businesses that present insurance for collector autos, American Collectors Insurance is probably the one other company you’ve heard of aside from Hagerty.

At Compare.com, it’s our mission to seek out simple methods to assist our customers get monetary savings on the things they want. While we associate with a few of the corporations and types we talk about in our articles, all of our content material is written and reviewed by our impartial editorial staff and never influenced by our partnerships. Learn about how we generate income, evaluate our editorial standards, and reference our information methodology to study more about why you possibly can belief Compare.com. Enter your info to see how a lot you can save on auto insurance.

This just isn't a whole listing, as with all insurance coverage coverage, the best way to find nice coverage at a price you can afford is to shop around. In most circumstances, you and your insurance firm will agree on the guaranteed value of the car and your premium shall be primarily based on that figure. If the automotive is destroyed, you could be paid the agreed-upon or assured worth quantity. Classic auto insurance coverage typically pays out a particular agreed-upon value if the car is destroyed instead of the actual money value.

No comments:

Post a Comment